Not only are the rates 2 lower. Additional exemption of RM8000 disable child age 18 years old and above not married and pursuing diplomas or above qualification in Malaysia bachelor degree or above outside Malaysia in program.

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

5001 - 20000.

. With effect from YA 2010 the exemption is extended to cover interest or discount from Islamic Securities Sch 6 Para 35b. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. Taxable Income RM 2016 Tax Rate 0 - 5000.

A 323 dated 23 October 2017 exempts non-resident person from payment of. 9 Order 2017 The above order gazetted on 24 October 2017 exempts a NR from payment of tax on income under sections. Income Tax Rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

A 2532017 allows an income tax exemption in respect of statutory income equivalent to the amount of the capital allowance determined under PU. Malaysia shall not be less than 500 inbound tourists per year. Apr 24 2017 Simply RegisterSign.

The Income Tax Exemption No. Effective from YA 2017 This proposal aims to provide clarity and. Income tax exemption for 2017-2018.

22 The provisions of the Income Tax Act 1967 ITA related to this PR are sections 2 6 7 109A subsection 1132 paragraph 391q Part II of Schedule 1 paragraphs 21 and 22 of Schedule 6. Effective 6 September 2017 the Government through the Income Tax Exemption No9 Order 2017 PU. Applications for the exemption would have to be submitted to Talent.

20001 - 35000. Income Tax Exemption Order 2017 PUA 522017. OBJECTIVES Any religious institution or organization which fulfills the requirements stated under PU.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only. KUALA LUMPUR Oct 21 Prime Minister Datuk Seri Najib Razak announced today a full waiver of stamp duty for first-time home buyers from the current rate of 50 per cent. Exemption is extended to discount received Sch 6 Para 35.

Effective YA 1997 to YA 2004 a tax exemption of up to 65 of statutory income from this source will. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company. 8 Order 2017 the Principal Order which exempts a qualifying company from payment of income tax in respect of statutory income derived from a.

Above exemption shall only apply to a wholesale fund which complies with the relevant guidelines of the Securities Commission Malaysia. All disposals made after such 5-year period are. Responsibilities Rights of Individual.

A 522017 shall be entitled to enjoy the. The tours have to be certified by the. Authorised Economic Operator AEO ASEAN Customs Transit System ACTS Free Zone.

The application for a. The exemption would apply only to women returning to the workforce after a career break of at least two years as of 27 October 2017. 9 Order 2017 Income Tax Exemption No.

Baojun E100 All Electric Battery Cars Are Seen While Being Charged In The Parking Lot In Front Of A Baojun Nev E Car Sustainable Transport Green Transportation

Regulatory Update For China S Nev Market Pwc

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Pdf The Discussions Ofislamic And Conventional Tax Incentive Towards The Corporate Tax Planning Level In Malaysia

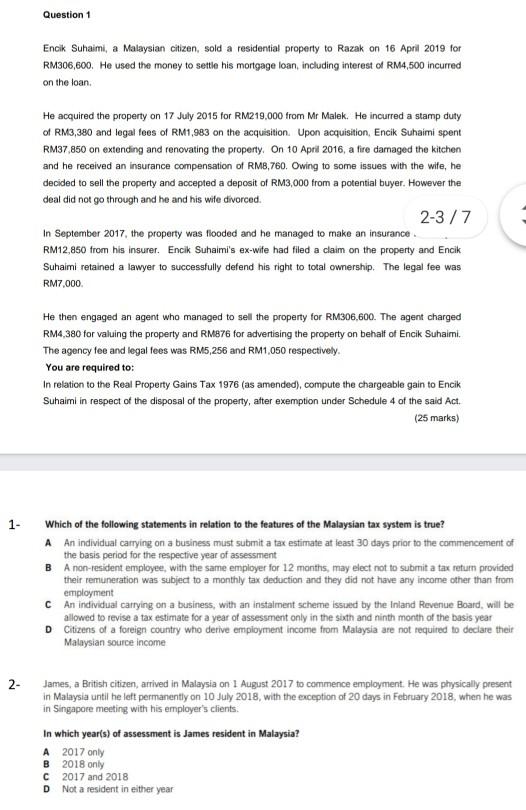

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

Webiste Islamic Relief Malaysia Islamic Relief Humanity Lifestyle Irmalaysia Social Media Islamic Relief Islam Mobile App

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Pdf A Framework Of The Energy Efficient Vehicle Initiative And Its Implementation In A Developed Country The Case Of Malaysia

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

Malaysia S 2018 Budget Salient Features Asean Business News

2017 Malaysian Tax Booklet Flip Ebook Pages 1 50 Anyflip

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary